Elevate Your Financial Future with us

We offer a range of expert services designed to support your financial journey and business success.

Same Day Processing

Once approved, you can have the funds in your business account on time.

Business Financing

Starting from $100K

Review within

One working day

Rates starting at

2.1 % / Year

How It Works: Three Steps to Funding Your Future

As a leader in small business growth funding, we understand that timing is everything. Unlike most banks, we're focused on providing the most flexible financing options available.

Easy Apply

Submit the easy online application and within minutes, a loan representative will enagage discussion with you for your funding request.

Get a Decision with Flexibility

Custom tailored approvals specific to your business needs.

We'll make our funding recommendation within a few hours

Receive your funds with transparency

Your business bank account receives the next following business day the loan amount and speedly. Spend it with peace and mindful.

$ 1 billion

Distributed

+120k companies

accross the world

A+

rating with the Better Bureau

Comprehensive Financial Solutions

Tailored to your needs

Access Capital

Access Capital

- Terms ranging from 6 months to 24 months revolving

- Rates starting at 1%*/month

- Credit lines up to $10,000,000

- Line increase eligibility every 60 days

- No pre-payment penalties

Equipment Financing

Equipment Financing

- Terms range from 1 to 10 Years

- Rates starting at 2.1%*/year

- Finance up to 100% of equipment value

- No pre-payment penalties

Business Line of Credit ( LOC)

Business Line of Credit ( LOC)

- Flexible financing option that allows businesses

- Funding up to $15,000,000

- Rates starting from 2%

- Only pay interest on what you use

- Short-term financing needs (better than a term loan for flexibility).

Join our network ofhappy customers!

Average Turnarounds

You can be approved within 24 hours and be funded the next following day.

Flexible Terms

Borrow up to $15 million of working capital — with no usage restrictions.

Application Fees

Application fee between 0.5% - 1% is only paid when funded. We’re here to make things easier and less expensive for you.

No Prepay Penalities

We'll never charge a client for accelerating their payment term — just another way that we always have our clients' best interests in mind.

Minimum requirementsfor Business Loan Approval

- 1 Year+ Business Tenure

- Available Register Business Bank Account

- $100k Minimum Business Annual Revenue

- 625 Credit Score

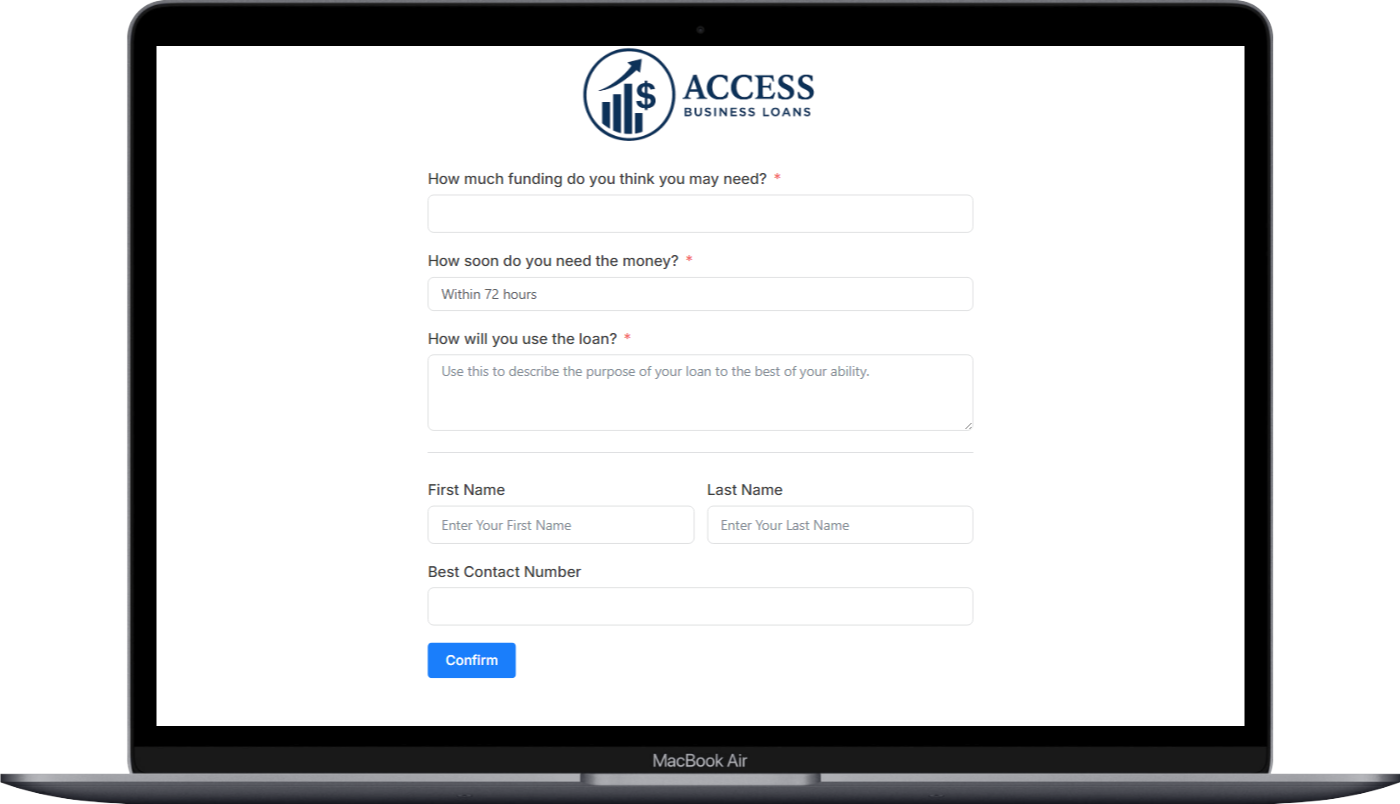

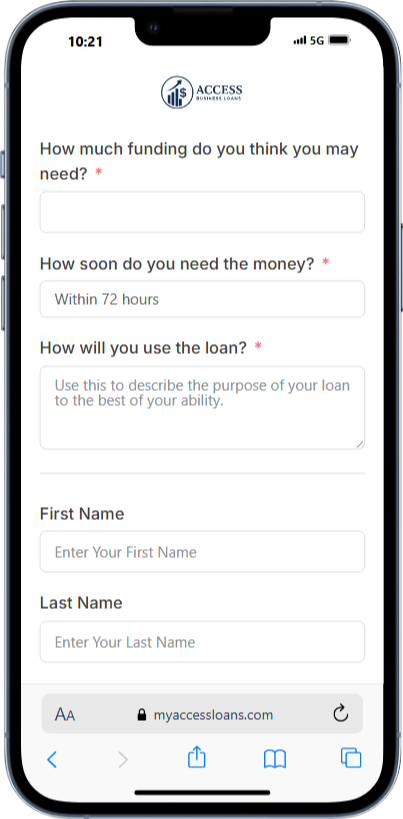

Just 3 steps to get thisfunding started!

At Access Business Loans we keep the application process simple so you can focus on meeting your business needs, from keeping payroll covered to purchasing more inventory in busy seasons.

Apply Online

Just a few quick questions and away we go

Get Approved

Get your approval and jump for joy!

Receive Your Funds

Accept your terms and the funds are on the way!

“I've worked with other lenders before, but none have been as efficient and honest as Access. They've earned my trust, and I’ll definitely be returning for future funding needs.”

– Robert M., Auto Repair Shop Owner, Chicago, Illinois, USA

“As a small retail store owner, I was skeptical about online lenders. But Access made the process simple and stress-free. I had funds in my account after approval of the documents I submitted and business bank account ready”.

– Maria L., Boutique Owner, Baltimore, Maryland,USA

“Our construction company needed quick capital to purchase new equipment. The team at Access Business Loans was responsive, knowledgeable, and got us a great deal with a manageable repayment plan.”

– James T., General Contractor, Antwerp, Belgium

“I appreciated how transparent Access Business Loans was from the beginning. There was no hard credit pull, and the application took less than 10 minutes. Highly recommend for any growing business!”

– Angela P., Café Owner, Bruges, Belgium

“We were expanding our e-commerce business and needed working capital fast. Access Business Loans understood our needs and delivered. Without them, our launch would’ve been delayed.”

– David K., Online Retailer, Birmingham, UK